Top 5 Cloud Accounting Software Concerns and How to Overcome Them

Published in Insight - Fall 2015

By Nickolyn Hansen, CPA, CMA, MBA/MIS

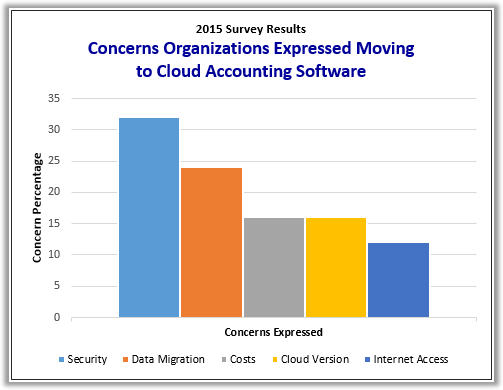

Recently, nonprofits, churches, ministries, and 501c(3) organizations completed a survey identifying their concerns about using cloud accounting software. This article will cover those concerns with resolutions. The following graph displays the percentage breakout for the five concerns that will be discussed in this article.

#1: Security

Overwhelmingly, security in the cloud is the organizations’ biggest concern. Security concerns include several different aspects. The first aspect is the actual physical location of the servers. There are people in organizations who do not understand the cloud concept and do not realize that even though the accounting software is accessible from a browser window or other remote access software, there are still physical servers located at designated facilities, possibly even in other countries. A second aspect is the server owner’s ability to protect the organizations’ data from an on-line breach such as another party stealing the data, a virus corrupting the data, or disasters. A third aspect is the organizations’ ability to access their own data.

When using a true multi-tenant environment (one database structure being shared by many organizations), the owners of the accounting software will not allow any of the organizations to access the physical tables of data. The organizations can access the data only through the application’s user interface. The organizations’ inability to access the physical tables of data can be a traumatizing experience when they are accustomed to accessing their own SQL or other database tables of data. I understand this feeling because this was my initial experience when supporting clients that moved to cloud accounting software; however, I came to appreciate that I did not have to spend time resolving SQL errors, but could create a support case with the software company, and they resolved their database issues. This process allows me to focus on providing value added support to clients.

The owners of the servers and accounting software should be able to show how an organization’s data is being protected from physical access, on-line breaches, virus corruption, and disasters. In order to compare a cloud accounting software with an on-premise software, it is important to make a true evaluation of the organization’s security in all the same major aspects. I have seen clients lose their data because their server rooms were not properly cooled; their data was not properly secured from employees who accidentally deleted thousands of records of historical data; they had not performed a proper backup to recover from corrupted data and server crashes; and more. Recently, I spoke with an owner who had her office broken into. Fortunately, the computers were not stolen. If they had been stolen, the organization would have been in serious trouble because they did not have proper data backups. Another on-premise software user explained how an electrical storm fried the organization’s server and desktop computers. Just because an organization has its data on-premise does not mean it is secure.

Some organizations that have cloud accounting, or are interested in subscribing to it, want to be prepared for the Black Swan event (the unexpected happens) and are choosing to store their cloud data on-premise. This way they have access to their data if they lose their access through the Internet, or if they run into an issue with the software provider not allowing the organization to download their data and migrate to another accounting software. When an organization is interested in storing their cloud data on-premise, they should work with the cloud accounting software company to determine the best way to do so and then incorporate the costs when running cost comparisons between accounting software choices.

#2: Data Migration

Another concern expressed by organizations is moving their historical data from their current accounting software to a new cloud accounting software and the time involved. There are decisions that need to be made to handle these concerns. The first decision is to determine how much of the data really needs to be in the new accounting software. Initially, some organizations plan to import all their data, but after researching, they conclude they need to bring in only two years of data because the earlier data is full of bad data, they had changed their chart of accounts so the data from one time period to another does not match, or they ran only comparative reports for the last two years. Another decision that needs to be entertained is whether to migrate the data in monthly summary amounts or in transactional details. Migrating summary data is less time consuming in the data collection process, the data formatting process for the upload files, and the verification process, and it provides monthly comparative reports.

It is important to note that the historical data being migrated should be general ledger data. Some organizations have tried to migrate historical accounts payable, accounts receivable, bank transactions, etc., into the new accounting software’s corresponding modules, and none of them were successful. The reason they were unsuccessful was that the organizations were not able to keep up with the time commitment required to obtain the data from the old accounting software, format the data for the upload file, manually input specific data into the new accounting software, and verify the data’s accuracy.

If an organization wants to bring years of historical data into the new accounting software, then the organization should be prepared to invest significant personnel time in the process and to investigate the new software’s field upload capabilities. For example, the organization would like to associate the customer, the vendor, and the item information along with the date and the chart of account number. Not all accounting software have the general ledger data fields to handle the desired data, but some do. I have worked with organizations that have wanted to bring years of detailed historical general ledger data into their new accounting software, and they were willing to make the time commitment. Therefore, we were successful with the migration. Also, be aware that the more time a project takes, the more resources that will need to be invested with both the organization and the partnering company that assists with the migration.

#3: SaaS Cost vs On-Premise Cost

Another concern is the cost of a SaaS (Software as a Service) platform verses an on-premise platform. The organization with an on-premise platform is responsible for the on-going costs of annual software

enhancement renewals, the servers, hardware upgrades, operating system software, accounting software and database software for mid-market accounting software, software upgrades, remote access software, database backups, disaster recovery, server crashes, and IT personnel. The SaaS platform subscription includes all the server hardware and upgrades, disaster recovery services, software upgrades (up to 4 major per year, depending on the software), data storage, mobility, browser accessibility, and more, depending on the cloud accounting software.

Some organizations make an incomplete comparison between the costs of a SaaS versus an on-premise accounting software and feel they do not want to migrate to the cloud because they have already purchased their on-premise accounting software verses paying for an annual SaaS platform subscription. However, as noted above in the list, the organization has ongoing costs with on-premise accounting software, including annual software enhancement renewals.

An organization should consider several areas of cost when comparing a SaaS verses an on-premise accounting software. We will not go into details for each of the areas, but will provide only an overview. There are three areas that should be evaluated when getting as close as possible to a comparable comparison:

1)

The first area is the TCO (total cost of ownership) of the on-premise software. The list above provides a good start to help make a determination, but the organization may need to include other costs as well as they relate to its specific situation. For example, the organization will want to include the costs when using a consulting company that manages the off-site backups.

2)

The second area is the ROI (return on investment) of the new accounting software. For example, determine the amount of time the organization takes to manually generate reports within Excel that the new SaaS costing accounting software will do for the organization. To generate a dollar value, determine who is doing the reports manually and how much time they spend each month. Multiply the number of annual hours spent working on the reports by the employee’s hourly rate. This calculation will provide the cost per year spent manually generating reports that the new accounting software will generate automatically.

3)

The third area is the FOI (future opportunity investment) of the new accounting software. This area is much harder to assign a dollar value. The organization looks at its future plans and determines how the accounting software can facilitate those plans. For example, the organization has a donor management or a CRM (customer relations management) software and wants to integrate it with their accounting software. The organization needs to determine if the current or the new accounting software can integrate with the donor management or the CRM software, and if they will be able to use an existing integration, or if they will need to have an integration built. The costs associated with the current and the new accounting software would be included in the overall comparison.

#4: No Cloud Version of Current Accounting Software

Some of the organizations were not interested in cloud accounting software because their current accounting software does not have a cloud version. Organizations need to determine whether they should stay on their current accounting software and wait until their current accounting software may get a cloud version sometime in the future, or if they should go to a cloud accounting software that already has experience being a cloud software. One of the questions an organization should ask its current accounting software company: Will the organization be able to upload all its detailed modular historical data without having to spend a lot of time and money? Another question to ask: When will all the on-premise functionality be available for the cloud version? The organization should also inquire about the subscription cost the accounting company will charge.

Organizations will want to take into consideration the benefits of waiting for a cloud version of its current accounting software (if there are plans for a cloud version), or consider existing cloud accounting software that is already available and can provide the functionality the organization will need to be ready for future challenges and growth.

#5: Internet Access to Data

Organizations were also concerned about accessing their data using the internet. There are areas in the United States that do not have dependable high-speed internet access. I have encountered this issue with organizations that are located in cities. Sometimes the organization will need to wait for the internet providers to install the infrastructure before having access. If the internet is not reliable, the organization can verify if it has access to more than one provider. Some organizations choose to have multiple internet providers to increase internet reliability. If the organization is going to increasingly move more of its software applications to cloud software, it will need to have fast and dependable internet access that accommodates the amount of data traffic it will be sending and receiving over the internet.

Conclusion:

We hear about security breaches being experienced by organizations using the internet to store data, and it is real that security of the data both physically and virtually is a concern; however, some organizations that have their data on-premise find their data is not as secure as they thought it was, and it could be more secure in a cloud accounting software.

Migrating data from an existing accounting software to a new accounting software can be a daunting and time-consuming task; however, some organizations that think they need all their historical detailed data migrated to the new accounting software later realize they do not need all the data, only the latest data.

Middle-market cloud accounting software is usually more expensive as a SaaS platform when compared to only the cost of the on-premise accounting software itself; however, the SaaS platform subscription includes all the server hardware and upgrades, disaster recovery services, software upgrades (up to 4 major per year, depending on the software), data storage, mobility, browser accessibility, and more, depending on the cloud accounting software. To make a viable cost comparison between a SaaS platform and an on-premise platform, the organization also needs to include all the on-premise costs for a true comparison. On-premise platform costs include the accounting software purchase and enhancement renewals, the associated hardware, hardware upgrades, operating systems, software upgrades, remote access software, database backups, disaster recovery, server crashes, IT personnel resources, and other associated costs for the organization. The comparisons are more meaningful when costing a SaaS platform to an on-premise platform over a five year period.

Organizations should be aware that when their current on-premise accounting software companies advertise a cloud version of their software some of the companies are merely hosting their current on-premise versions, and they are not creating a true cloud version. This is important because mobility will be limited and the upgrades will not be performed universally across all organizations using the accounting software. Some organizations think they will have the ability to migrate all their current and historical data from the on-premise version to the cloud version;however, this may not be possible and the organization should contact their on-premise software company to determine the process and the amount of their on-premise data that can be migrated to the cloud version.

Internet access is relatively easy to determine for both speed and reliability; however, if the organization is in a bad internet access area, it may be more challenging to determine when the reliable high-speed internet access will be available.

Each organization must identify their current and future needs to determine whether they should stay on the current on-premise software or migrate to a cloud accounting software and to which software. As the internet gains in popularity, more and more applications are moving to the SaaS platform. Unless something happens to undermine the Internet, eventually the accounting software industry will move away from the on-premise platforms.

Nickolyn Hansen is Intacct Implementation and Service Providers Certified and a Dynamics GP Certified Masters. She has been involved with technology for over 25 years and provides ERP accounting software implementation services, trainings, and on-going support. She can be reached at nhansen@nms-nh.com or visit www.nms-nh.com.